However, certain scholar checking account really go the extra mile to minimize charge. They wear’t charges month-to-month maintenance fees, or they make it simple to waive those people charge with college student status. Most other special features tend to be early use of head put, entry to as much as sixty,one hundred thousand commission-free ATMs, powerful mobile banking, and 100 percent free usage of Zelle. You can couple their See family savings having Apple Shell out®, as well as your checking account equilibrium is FDIC-covered up to the most invited.

Discover a capital You to Café otherwise lender part close by.

Other factors, including our very own proprietary web site legislation and you may if or not something is out https://mrbetgames.com/10-deposit-casinos-new-zealand/ there close by otherwise at your mind-chose credit rating variety, may also effect just how and you can where points appear on this site. Even as we try and provide an array of now offers, Bankrate does not include information about the financial otherwise borrowing from the bank equipment otherwise provider. BrioDirect’s High-Produce Checking account also offers a competitive produce, nonetheless it needs a steep minimal put of $5,100 to open up. After you discover the new membership, you can keep less cash inside if you want, however you will you need at the least $twenty-five to make the fresh bank’s large-produce savings APY. Note that BrioDirect will not offer any profile today.

Now you’ll be able to secure step 3.60% to the its leading checking account, than the 0.87% about ten years ago whenever rising prices try beneath the Fed’s 2% address. I feet our very own decision on what banking companies and you can things to provide within listing only for the a separate methods, which you can find out more on the lower than. U.S. Lender in the past offered a good $450 checking extra for opening a different account.

Neither Chase nor Zelle® also offers compensation to have authorized repayments you create having fun with Zelle®, except for a small compensation system you to definitely is applicable definitely imposter scams for which you sent currency with Zelle®. It reimbursement system isn’t needed legally and may also getting modified or deserted any time. Exact same web page hook up efficiency to footnote site 2Your being qualified mortgage must be connected and enrolled in automated costs to the business day until the avoid of one’s report period.

Pursue Financial (Complete Examining)

The new city’s fundamental streams was dependent during the those people many years, as well as the start of your own 20th millennium watched the construction of Southern America’s tallest houses and its very first below ground system. Another construction increase, from 1945 in order to 1980, reshaped downtown and much of one’s urban area. When you’lso are zero high improvements were made, pages can invariably enjoy playing from the such internet based casinos. Online casinos inside the Illinois provide set of commission running choices to match the varied criteria of its benefits.

Galician code, cuisine and people had a primary presence around to own all twentieth century. Lately, descendants out of Galician immigrants features added a small increase inside Celtic tunes (that can highlighted the brand new Welsh lifestyle away from Patagonia). Yiddish is actually are not read in the Buenos Aires, particularly in the brand new Balvanera apparel area plus Villa Crespo up to the fresh sixties. The brand-new immigrants discover Language quickly and you can absorb on the town life. The newest Buenos Aires Metropolitan Cops is actually the police push within the expert of your own Independent City of Buenos Aires.

Xavier Deserving 2024 Prizm #M-XWO Manga Case Struck Newbie RC Ohio Area Chiefs

You could discovered one the fresh savings account starting relevant incentive the couple of years on the history voucher registration time and only you to bonus for every membership. Here are some crucial have to look at while looking for a leading-yield checking account. Whenever choosing, and take a look at Bankrate’s professional reviews from well-known financial institutions, many of which give large-focus discounts membership. The fresh Rising Financial Large Give Bank account offers an aggressive focus price but a fairly large lowest starting put out of $step 1,000. You will additionally need to keep at least $1,100000 regarding the account to make the fresh APY. While you are Pursue also provides several solid membership bonuses, it’s still well worth comparing the choices.

- With a plus Savings account (which brings in cuatro.62% APY), the benefit Family savings produces an incredibly big rate from cuatro.50% APY.

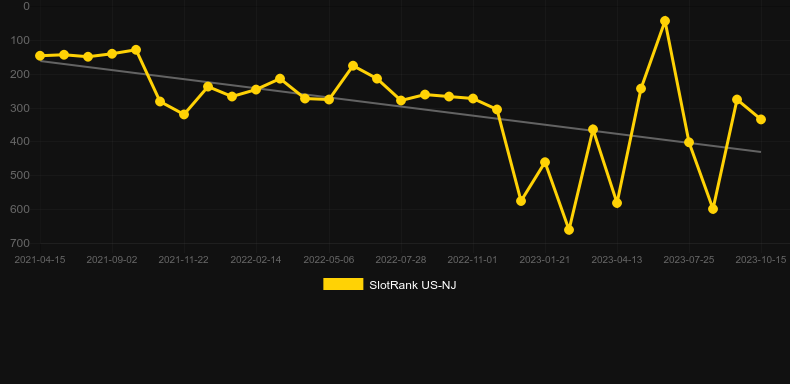

- To your an associated notice, absolutely the finest cost for the our very own graph recently had been the answer to “just who hasn’t yet – however, have a tendency to – get in on the latest round of reduces”.

- None Pursue nor Zelle® also provides compensation to possess registered costs you make having fun with Zelle®, apart from a limited reimbursement system one can be applied without a doubt imposter cons in which you sent money having Zelle®.

- Vanguard Brokered Licenses out of Places involve some of one’s high prices on the market, nonetheless they come which have a threat.

Moms and dads discovered a good debit card due to their infants, which they may use to set investing limits, do discounts requirements, and also start using. Specific scholar checking accounts positively restrict membership so you can younger people, frequently the individuals ranging from 17 and 23 otherwise twenty-four years of age. It’s simple to unlock a student family savings, as most banking companies offer the alternative online. Pursue customers get access to over 15,100000 ATMs and you may an effective cellular application to deal with all your financial needs.

The cash Software Credit can be used to make withdrawals away from ATMs and also have cash return in the checkout. CNBC Find looks at Bucks App’s financial provides and you can observes exactly how it stack up to the competition. Whether you are protecting to own a downpayment, emergency fund or senior years, which have an obvious, certain deals purpose can help you sit determined and you will tune progress. Charges can cut into your attention income, so make sure you aren’t spending these. Your website is actually covered by reCAPTCHA plus the Privacy and you can Terms of use pertain.

Mediocre currency market costs

Certain banking institutions tend to to switch rapidly, while some can get hold off depending on how far they require to draw deposits. Online banking companies, that have all the way down doing work costs, can get remain giving higher prices longer than highest old-fashioned banks. As the slash was only revealed, offers prices have not but really changed. Costs to your savings profile fundamentally move off in the lockstep with rules slices. The brand new Presidential Lender Advantage Family savings try a powerful choice for savers looking to unlock both a verifying and you may savings account and you can rating very aggressive cost. Having a bonus Checking account (which produces 4.62% APY), the bonus Checking account earns an extremely ample speed out of 4.50% APY.

The guy recommended caution to help you “guard against the risk of cutting costs both too much or too quickly”. A part of your price-setting Monetary Plan Committee (MPC), Tablet said this morning root rate gains is toostrong and you will highest rising cost of living standards risked as embedded. Rates might have to be slashed far more slowly due to stubborninflation, according to Lender from England captain economist Huw Tablet. Worries about regional Us lenders’ experience of bad finance provides managed to move on so you can Europe, that have banking institutions being the biggest fallers to the FTSE one hundred. There has been, to date now, the most significant everyday lose of one’s UK’s benchmark stock index inside the 6 months.

You will find a monthly provider charges to your both account which can become waived for those who meet the requirements. On the ONB Common Checking account, it is waived for those who have a good $5,100000 each day equilibrium or look after an excellent $twenty five,one hundred thousand shared lowest each day balance certainly one of the put accounts. On the ONB Casual Examining, you should buy the price waived for those who manage $five hundred directly in places each month, manage a daily equilibrium from $750, otherwise care for a mixed every day equilibrium away from $1,five hundred inside deposit membership.